Conspiracy Theories Debunked: Financial Cartels and Collapse of the US Dollar

- Mandeep Sohal

- Oct 8, 2023

- 6 min read

Updated: Oct 22, 2023

Hi folks,

The main reason I started a blog and podcast is because there is so much financial degeneracy being peddled on the internet.

I wanted to undo financial pseudoscience and create a model of what “good” looks like. Good is dollar cost averaging into market-cap weighted index funds in a tax-efficient manner.

However, one of the things that can absolutely destroy your progress while you're index investing is taking in bad advice and deviating from your plan of action. Today I’m going to debunk some conspiracy theories you may have come across.

One popular conspiracy theory is that Vanguard, State Street, and Blackrock have shareholder rights and essentially own the largest companies in the US like Apple, Google, Home Depot, etc. Presidential candidate Vivek Ramaswamy even goes as far as to say they are ‘arguably the most powerful cartel in human history.’

While I like that Vivek is an Indian-American running for political office, that’s about all that I like about him. Vivek went to Harvard to get his bachelor’s degree, and Yale to get his law degree. He’s worked at hedge funds and even started a successful pharmaceutical company called Roivant, which is, honestly, nothing short of exceptional.

The reason I bring this up is because this is all evidence that Vivek is neither naïve nor ignorant. He’s just telling bold-faced lies.

Let me take a minute to explain.

Vanguard, State Street, and Blackrock have index funds that you or I can buy into. The index funds are funds that follow an index, like the S&P 500, CRSP, etc.

Let’s take the case of the S&P 500 index fund. Vanguard’s VFIAX fund (Vanguard 500 Index Fund Admiral Shares) has shares of the top 500 companies by market capitalization or essentially matches the S&P 500 index, which has the ticker symbol SPX.

SPX is just the index; you cannot buy the index, but you can buy an index fund. The index fund VFIAX simply tracks the index and contains shares in equal proportions to their market weight - they match the index. Most index funds are weighted to the market capitalization. What does this mean? This means if Apple makes up 8% of the S&P 500, it also makes up 8% of the index fund. There are exceptions like market cap equal index funds, but again they are exceptions; they are not the rule.

In order to match the index and the fluctuations of the market, the fund’s operator, Vanguard, in this case, employs computer algorithms to track the index, buying and selling shares to match the index. This costs Vanguard money, which is why you only pay them a measly 0.04% - the expense ratio of the fund to operate the fund through their computer algorithms. Vanguard makes almost no money when you buy index funds, but it costs them almost no money. This is because a computer is doing all of the trading. There is no evil, conspiracy-theory fund advisor hand-selecting winners and losers.

People like you and I, millions of us, buy the funds, thereby owning the stocks in the funds. So the Vanguard ‘ownership’ of the largest companies is actually split up into tens of millions of pieces by those that own the fund. This is you and I. Vanguard has ‘assets under management’ (AUM), but this doesn’t mean ‘assets under ownership.’ They manage the fund. We own the fund. There’s a difference.

Vanguard can’t go to Apple and tell them to enforce a particular initiative because they have no upper hand. The index fund, by definition, matches the index. If Vanguard says we’ll remove Apple from the index fund or push Apple down from 8% to 7% unless they cater to our demands, the index fund is no longer an index fund. Apple can simply tell Vanguard to kick rocks because Vanguard has zero control over Apple’s inclusion into the index fund or their market-weight in the index fund.

Unfortunately, social media catches like wildfire, which is probably why this lie is really popular nowadays.

So what is Vivek’s incentive for making these statements?

Vivek is vocally anti-ESG (environmental, social, and corporate governance), and this lie fits his fairy-tale narrative of Vanguard, State Street, and Blackrock pushing their ESG goals to S&P 500 companies.

Normally, I would end the article here, but I’ll take a second to break down another la-la land fairytale that is being propagated like a virus by many people - Peter Schiff, for example.

This fairytale narrative states that the US dollar is going to collapse with the BRICS countries creating a unified currency. For the uninitiated, BRICS means Brazil, Russia, India, China, and South Africa. The doom-and-gloomers are painting a narrative with negative sentiment around inflation, national debt, and the annual budget deficit.

Lies don’t work when they are obviously untrue. They do work when 90% of the stuff you say is fact, and then you build a logical framework around that to tell your little lie. Many of these things are absolutely happening. You don’t need to be a genius to realize inflation is outrageous in the US right now. National debt is high. America is in financial pain. However, the US dollar collapsing? Come on…

Why is this not likely? When the US real estate collapse happened, residential real estate only made up about 7% of GDP (Source). Specifically, “Home ownership in this period rose from 64 percent in 1994 to 69 percent in 2005, and residential investment grew from about 4.5 percent of US gross domestic product to about 6.5 percent over the same period.” It was globally catastrophic and resulted in a global financial crisis. Residential real estate being 7% of US GDP was enough to shake up the world economy. The US GDP was about 15 trillion, and world GDP was about 60 trillion at the time. This means US residential real estate made up 1.75% of world GDP. Despite making up just 7% of US GDP, residential real estate blowing up in the US was enough to bring the US stock market to its knees.

This brings us to problema número dos (problem number two).

A country's stock market is traded in the local currency of that country. The US stock market is traded in the US dollar. The London stock exchange uses the British Pound. This is referred to as “currency risk” in the book “The Simple Path to Wealth by JL Collins” with regards to international index funds. This is why JL Collins just invests in VTSAX (Vanguard Total Stock Market Index Fund Admiral Shares). International index funds do have risks including, but not limited to, “currency risk” and “regulatory risk." However, The Bogleheads' Guide to the Three-Fund Portfolio still recommends 20% international stock exposure. I won’t go into this in great detail for the sake of brevity.

If the US dollar collapses, US stocks will also crumble on the world stage as they are traded in US dollars.

The big question is: how much of the world stock market does the US stock market make up?

If the US dollar collapsed to zero, that’s 30% of the world GDP that would go up in flames. China is number 2 at 19%. Japan is number 3 at about 5%.

The problem with this narrative is if real estate, which made up a measly 1.75% of world GDP was enough to collapse the US stock market and bring banks in Greece and Iceland to their demise, what happens if the US dollar loses 50% of its value? That’s 15% of worldwide GDP.

This would be a financial nuclear explosion unlike anything we have ever seen.

The US dollar collapsing is in no one’s interests – not even China's or Russia's.

So why is this being popularized by figures like Peter Schiff? Is it because he has something to sell you?

As you might have guessed, absolutely.

He’s selling gold and gold funds, and his goal is to get you off the US dollar and into gold as a medium of exchange. Unsurprisingly, he’s just another wolf in sheep’s clothing…

I’ll still be investing about 90% of my earned income into index funds bought and sold in US dollars. It’s the same thing I was doing 7 years ago, and it’s the same thing I’ll be doing for the next 30 or so.

It wasn’t all that long ago that I was trying to undo crypto degeneracy, and now we have this... at least I won’t run out of things to write about. LOL.

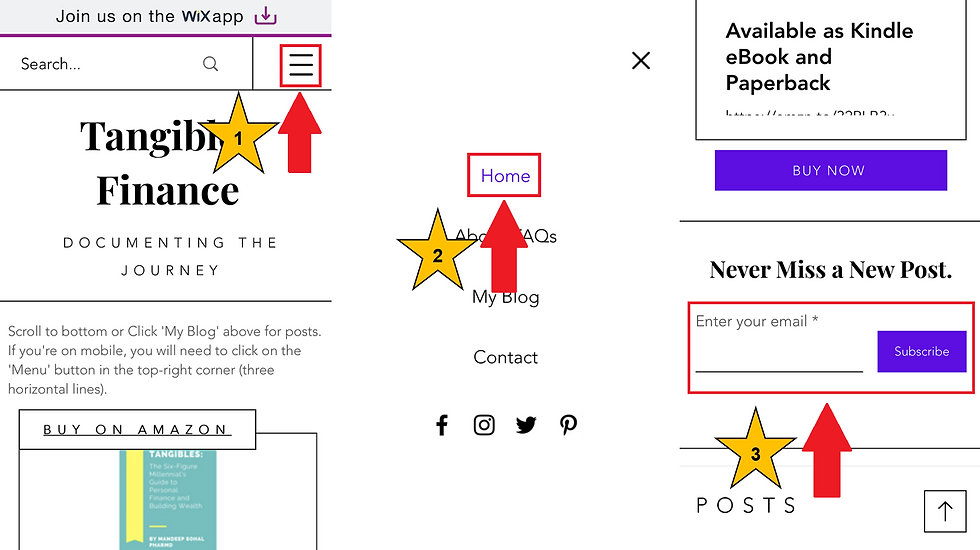

Also, if you're coming from LinkedIn, you can get these articles sent directly to your email inbox without having to wait for a LinkedIn notification (and potentially missing one).

If you'd like to do this, all it takes is three simple steps.

Tap on the the 3 lines to bring up the menu.

Tap on Home.

Scroll down to "Never Miss a Post" and enter your email address.

You'll be notified every time I post. Visuals are below.

Disclaimer: The article above is an opinion and is for informational/educational purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. The author has taken care in writing this post but makes no expressed or implied warranty of any kind and assumes no responsibility for errors or omissions. No liability is assumed for incidental or consequential damages in connection with or arising out of the use of this information.

Comments