How Common is the Yacht-Partying Instagram Millennial Influencer?

- Mandeep Sohal

- Dec 31, 2022

- 3 min read

Updated: Apr 2, 2023

Hi y'all,

Have you ever noticed on social media that many young people, who appear to be around 25 years old or younger, are frequently seen driving expensive cars and enjoying lavish parties on yachts?

It can give the impression that so many are living an extravagantly wealthy lifestyle. However, it's worth considering how genuine these displays of wealth are and what proportion of people are actually able to afford this kind of lifestyle. While partying on a yacht doesn't require a seven figure net-worth, it does have a cost. For your average pharmacist, renting a yacht might even be somewhat affordable if you have a group of similarly interested people.

Reality is sobering.

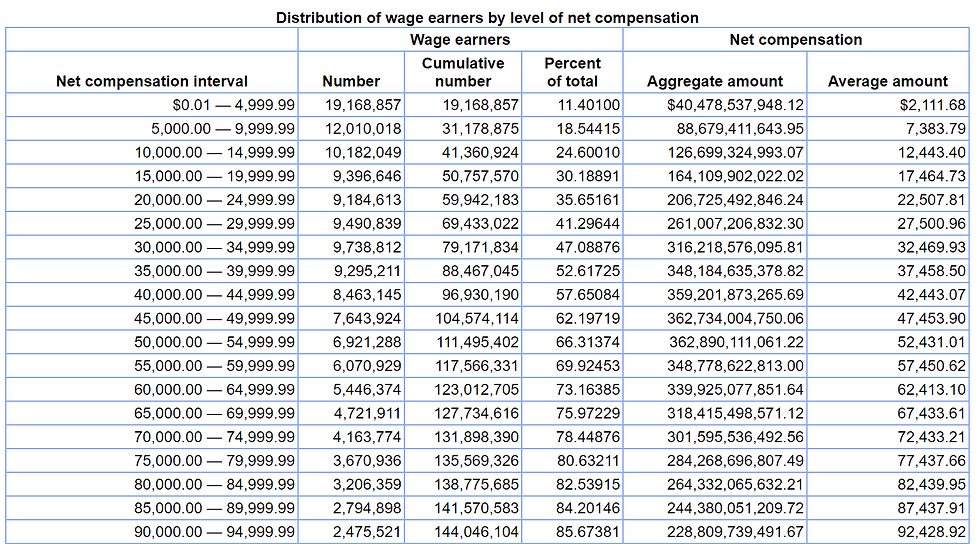

While the average household income in the US is often cited as being around $70,000, it's important to note that this figure doesn't give a complete picture of individual earners. To get a more detailed understanding of wages in the US, the Social Security Administration publishes annual wage statistics, which can be accessed at the following link: https://www.ssa.gov/cgi-bin/netcomp.cgi?year=2021.

I highly encourage you to visit this link. This table, from Social Security, is quite informative. Not only does it show you income in percentiles, but it also shows you how many people, in absolute values, fall into each income stratum.

If you earn more than ~$35,000 per year, you are among the top 50% of wage earners in the US in 2021. Earning more than ~$75,000 per year puts you in the top 20% of wage earners. As a reference, pharmacists typically fall within the top ~8% of wage earners, on average.

It's worth noting that these figures apply to all working individuals, regardless of age. If you are younger and earning the same amount as someone older, you may be in a higher percentile among your peer group.

It's important to remember that very few are living an ultra-luxurious lifestyle. If the ultra-wealthy follow the guideline of using no more than 10% of their income (10% rule) to purchase a car, driving a Lamborghini worth $200,000 would put them in the top 0.14% of wage earners in the US. However, they probably don't follow this rule. It's likely that a relatively small number of people in this income bracket are 25 years old or younger. The number becomes even more ludicrous when you examine yacht owners. While I couldn't find specific data on yacht owners, I did find that the CEO of Bugatti mentioned that the average Bugatti owner has 84 cars, 3 jets, and 1 yacht. That doesn't necessarily mean that the average yacht owner has a Bugatti and 84 other cars, but the Bugatti owner (~500 people) would be in the very last bracket.

So if you ever see this kind of content, know that these types of people are extremely, extremely rare, and there's a lot to be thankful for in life, like Ben and Jerry's Half Baked Brownie Chocolate & Vanilla Ice Cream.

While hearing 630 horses roaring behind you in a high-performance exotic automobile might seem like an exhilarating experience, there is a special kind of satisfaction that can only be found in a frozen dessert.

Speaking of which, it's time to make that long commute to my freezer.

RIP: Today's macronutrient goals.

Unilever (Ben and Jerry's) is not sponsoring this post. Although, if you are from Unilever, please feel free to reach out.

Whether you drive a Camry or a Corvette, the easiest way to increase your net worth is to put your W2 wages to work. One of the most accessible ways to go about this is to invest into the stock market.

How can you get all of the battle-tested, tried and true stock market education as quickly as possible? I wrote a book explaining exactly this; it's short; it's cheap, and it's written in plain English. You can find it here: https://amzn.to/32PLB3x. You may also want to consider subscribing to this blog by entering your email on the homepage next to the “Never Miss a Post” section and following the podcast “Nondelusional Investing” wherever you get your podcasts.

Is there anything you found useful or that I missed above? If so, please leave a comment in the comment box below.

See you on the next one!

Disclaimer: The article above is an opinion and is for informational/educational purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. The author has taken care in writing this post but makes no expressed or implied warranty of any kind and assumes no responsibility for errors or omissions. No liability is assumed for incidental or consequential damages in connection with or arising out of the use of this information.

Comments