Series I Savings Bonds - Time to Sell?

- Mandeep Sohal

- Dec 21, 2023

- 3 min read

Updated: Dec 27, 2023

Hi folks,

It may just be time to sell your Series I Savings bonds (iBonds). If you are currently unsatisfied with the current rate of your iBonds, one move you can make today is to sell your iBonds and move the resulting funds into a money market fund (VMRXX) where the current rate is 5.31%.

However, there are a few points to consider with iBonds. Your iBonds rate is not the same as the current rate. It depends on your date of purchase. You need to figure out what YOUR interest rate is, and when an undesired rate will come into effect.

Let’s take a look at an example. Rates are announced annually in May and November. However, your rate doesn’t necessarily change in May and November. For example, if you bought on the last day of April in 2022 at a rate of 7.12%, your rate would not change the following day in May to 9.62% (as shown in the chart below). You lock in the 7.12% rate for 6 months until October, when the 9.62% rate will go into effect. Your rate would change every April and October, and not every May and November. The same would apply if you bought in March; then, your rate would change every September and March. Rates are locked for 6 months from your purchase date.

For the complete list of historical rates, please see this link. Yes, it’s a super ugly chart, and you’ll really need to zoom in.

However, you also have a 3 month penalty (in terms of interest) if you sell before 5 years, which is what you will likely be doing. Therefore, you would want to be penalized on the lower rate and wait an additional 3 months for a total of 9 months. Some people may want to wait 9 months and others, 3 months, depending on the bond issue date.

Let’s look at another example. Let’s say you bought in December of 2021 and locked into the 7.12% rate. Your rate would renew every December and June (again, not May and November). Since you can get ~5% in a liquid money market fund, you’d want to sell your iBond when the rate is below this.

So what’s the correct date of sale? Let’s take a look at the above red box, since this pertains to our issue date. Since the purchaser bought iBonds in December of 2021, the May 2023 rate becomes effective in June at 3.38%, but we want to get penalized on the lower rate (and not 6.48%), so we wait an additional 3 months until September. December + 9 months = September.

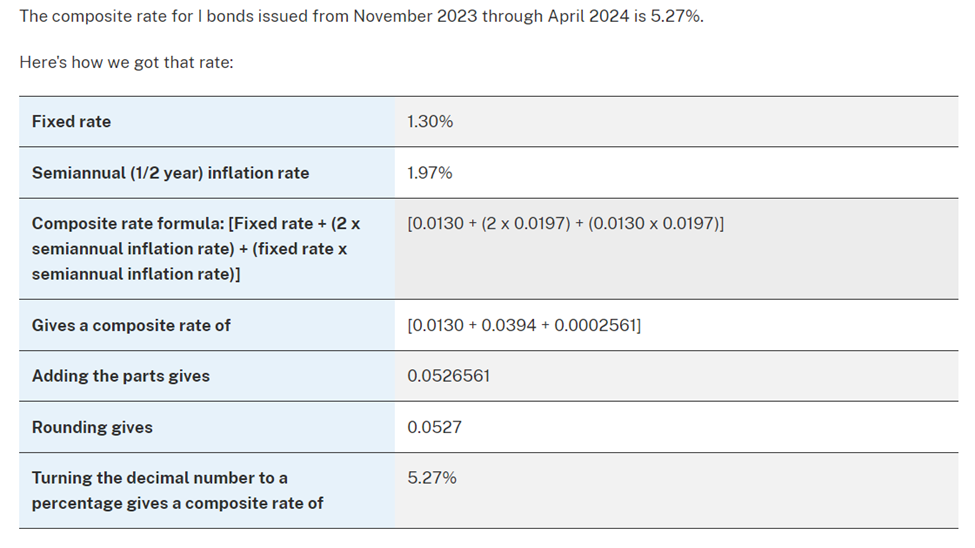

Why isn’t the purchaser’s current rate 5.27% as announced, Mandeep? Why is it 3.94%? This is because your rate is particular to your date of issue. The rate you get is a composite rate; it’s a combination of a variable rate (which does change) and a fixed rate (which doesn’t change). It’s not straight addition, but straight addition gets pretty close. As you can see, the new rate is 5.27%, which is almost 3.94% + 1.30% (fixed rate), which gets us 5.24% (the exact math can be found on the treasurydirect.gov website).

Here’s how the US treasury actually calculates it.

Hope this helps answer questions related to the current rate of iBonds including when to sell.

For answers to more questions directly from treasurydirect, please see this link.

While short-term investment vehicles (like iBonds) are great, it's important to have a strong foundation in personal finance education. How can you get all of the battle-tested, tried and true knowledge as quickly as possible? I wrote a book explaining exactly this; it's short; it's cheap, and it's written in plain English. You can find it here: https://amzn.to/32PLB3x. You may also want to consider subscribing to this blog by entering your email on the homepage next to the “Never Miss a Post” section and following the podcast “Nondelusional Investing” wherever you get your podcasts.

Is there anything you found useful or that I missed above? If so, please leave a comment in the comment box below.

Also, if you're coming from LinkedIn, you can get these articles sent directly to your email inbox without having to wait for a LinkedIn notification (and potentially missing one).

If you'd like to do this, all it takes is three simple steps.

Tap on the the 3 lines to bring up the menu.

Tap on Home.

Scroll down to "Never Miss a Post" and enter your email address.

You'll be notified every time I post. Visuals are below.

See you on the next one!

Best,

Mandeep

Disclaimer: The article above is an opinion and is for informational/educational purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. The author has taken care in writing this post but makes no expressed or implied warranty of any kind and assumes no responsibility for errors or omissions. No liability is assumed for incidental or consequential damages in connection with or arising out of the use of this information.

Comments