The Mega Backdoor Roth

- Mandeep Sohal

- Jun 9, 2024

- 4 min read

Updated: Sep 8, 2025

Hi folks,

Many of you may have heard of the Backdoor Roth IRA which I’ve posted about here, twice.

However, there is a separate, lesser-known, MEGA Backdoor Roth.

Firstly, the two should not be confused. You can execute a Backdoor Roth IRA contribution at any brokerage, and it is fairly simple to do so. There are just a few things you’ll need to keep in mind - you can find my guide for doing this here.

The Mega Backdoor Roth (again, which is not a Backdoor Roth) is contingent on your employer and your company 401(k). This strategy may allow you to contribute several tens of thousands of Roth dollars that will never be taxed again.

The contribution amount may even be more than the $23,000 employee contribution (2024 Max Contribution) you can make to your company 401(k).

Sounds pretty sweet, huh?

How does the Mega Backdoor Roth work?

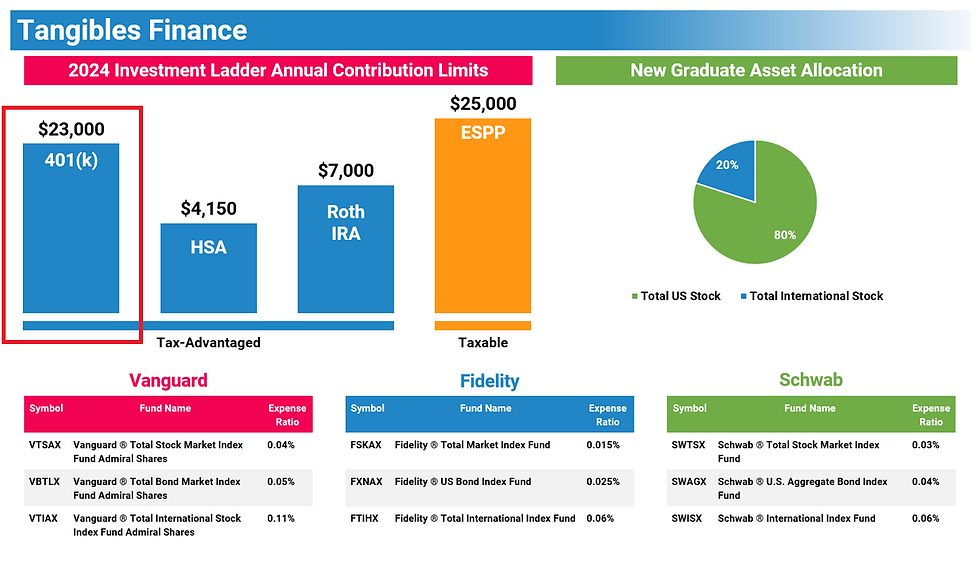

Well, you may already know about the $23,000 employee 401(k) contribution limit (left side of figure) if you’ve seen the below infographic that I’ve published online.

Your employer’s 401(k) matching contribution, if offered, is not subject to this limit. The employer contribution is in ADDITION to the $23,000, not a part of it.

Aside: In the case of an HSA, the employer contribution is a PART of the contribution limit.

The actual, total limit for 401(k) is $69,000 in 2024.

So what does this mean?

Let’s say you contribute $23,000 to your company 401(k). Let’s say your employer contributes a 5% match equaling $7,000. That puts your + your employer’s total 401(k) contribution at $30,000. However, the limit is $69,000. This means there’s $39,000 of unutilized, untapped dollars that you can’t do anything about.

However, if you have access to a Mega Backdoor Roth, you can do something about this and contribute an additional $39,000 (in our example) to your 401(k) plan and shield it from taxes.

The best news is that you can do BOTH the Backdoor Roth AND the MEGA Backdoor Roth in the same year. This means our hypothetical employee above can contribute $39,000 of Mega Backdoor Roth 401(k) dollars and $7,000 Roth IRA dollars for a total of $46,000 Roth dollars in 2024 + $23,000 as pre-tax 401(k) dollars + $4,150 of HSA dollars. And the employer is contributing $7,000 into the employee 401(k). That’s $80,150 tax advantaged dollars in a single year.

HOLY COW!!! That’s a lot of tax optimization ;)

In order to utilize a mega backdoor roth you will need the following:

1. Your 401(k) plan must allow “After-Tax” contributions. These should not be confused with “Roth” contributions.

2. Your 401(k) plan must allow for an automatic Roth In-Plan Conversion (auto-RIPC) or “In-Service withdrawals.” You have to have some way of converting After-Tax dollars to Roth dollars. After-Tax dollars, alone, do nothing for you in the ways of tax optimization.

You will need to call your company’s HR department and ask about the MEGA Backdoor Roth. Not all employers allow this.

Moreover, your HR department and potentially even your 401(k) service provider probably won’t understand what you are talking about unless you ask the following questions.

1. Does my 401(k) plan allow for After-Tax contributions?

2. Does my plan allow for a “Roth In-Plan Conversion” of “After Tax” funds, or, alternatively, for an “In-Service Withdrawal?”

The answer to both questions must be “yes” for you to use the Mega Backdoor Roth.

Please note, if the HR person has no idea what you are talking about and your 401(k) provider has no idea what you are talking about, you’ll want to ask for a supervisor or try the HUCA (Hang Up, Call Again) method.

Even your run-of-the-mill Fidelity representative has no idea what a Mega Backdoor Roth contribution is and may confuse the Mega Backdoor Roth with a Standard Backdoor Roth, even though Fidelity has articles of their own on the Mega Backdoor Roth.

It took me a few phone calls before getting to the right person. This step may take a bit of patience on your part, requiring the HUCA method. It’s well worth the financial benefit, though.

If you have an auto-RIPC, then your life is easy.

You’ll just need to set up your “After Tax” contributions and turn on auto-RIPC for “After-Tax” dollars ONLY! Do not, I repeat, do NOT set up auto-RIPC for “Pre-Tax” dollars, or you will be in a world of tax PAIN because you will dramatically increase your tax liability.

In simpler terms:

1. auto-RIPC for After-Tax dollars = YAY!

2. auto-RIPC for Pre-Tax dollars = BOO!

If you don’t have access to auto-RIPC, you’ll likely have to do an “In-Service Withdrawal” where the money goes from your 401(k) to your TIRA and Roth IRA. The “Pre-Tax” portion will go to a TIRA and the “After-Tax” and Roth dollars will go to a Roth IRA.

You’ll want to rollover your TIRA dollars to a Solo 401(k) in case you’re utilizing a Backdoor Roth IRA contribution, which you absolutely should.

Now, many of you may not have access to Mega Backdoor Roth because your employer does not allow After-Tax contributions. If you find yourself in this situation, consider writing a letter/email to your HR department to add this option. Letters are surprisingly effective and I would highly encourage you to do so.

Yes, you’ll need to be a little proactive with your efforts, but it is a small price to pay for shielding potentially $30,000 from tax liability per year. This may translate into $300,000 shielded from tax liability over a 10-year period and potentially millions of dollars by the time you reach retirement age.

There is one downside. You may reduce your paycheck to a very small dollar amount, potentially, one you may be uncomfortable with. However, this is the cost of moving money from your bank account to a tax-advantaged retirement account.

If you have any questions/comments, please find a comment box below.

Disclaimer: The article above is an opinion and is for informational/educational purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. The author has taken care in writing this post but makes no expressed or implied warranty of any kind and assumes no responsibility for errors or omissions. No liability is assumed for incidental or consequential damages in connection with or arising out of the use of this information.

Comments