How To Get a Minimum of 4.30% APY on Your Checking Account

- Mandeep Sohal

- Jul 3, 2023

- 2 min read

Hi folks,

You may recall I made a post about short-term investment vehicles a few months ago. You can find this post here.

One of the accounts I posted about has a few features that allows you to get 4.30% annual percentage yield (APY) on your CHECKING account balance.

How is this possible?

This is achieved through free overdrafts.

Essentially, you hold a $0 balance in your checking account and use the SoFi savings account as your checking account.

How does this work?

Let's say you hold $5,000 in your checking account to pay for recurring transactions. In order to make this system work, you would transfer your SoFi checking account balance to your savings account - also at SoFi.

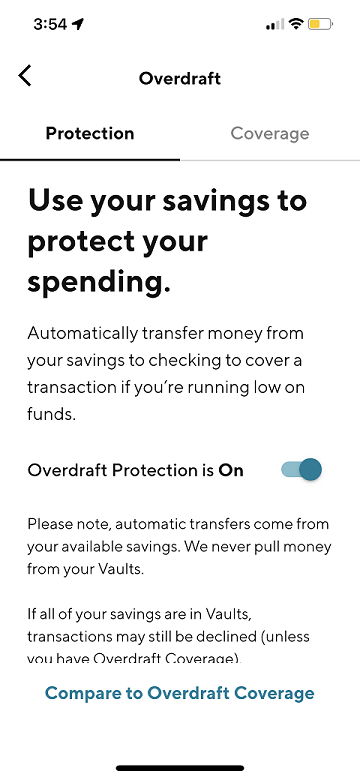

Now, you hold $5,000 in a savings account, and $0 in a checking account. After you turn the overdraft feature ON (pictured below), your checking account will automatically pull dollars from your savings account to pay for transactions.

Again, there are no overdraft fees.

Let’s say you have a credit card that is on autopay linked to your SoFi checking account, and the autopayment is $200.

SoFi will pull $200 from your savings account, reducing your savings account balance by $200 to $4,800. The $200 will automatically deposit in your checking account to pay for your credit card, again reducing your checking account balance to $0.

If you would like to open a checking and savings account at SoFi, please consider using my referral link here. If you use this link to sign up, you’ll get a $25 bonus from me plus $250 from SoFi when you set up direct deposit, and you'll earn 4.30% APY. If you don't use the sign up link, you'll only get $250 rather than $275.

So Mandeep, what do you use for your savings account?

Good question - I deposit my savings balance into VMRXX, which is the Vanguard Federal Money Market Fund.

Checking Account: APY: 4.30% [SoFi Savings Account with free overdrafts turned ON]

Savings Account: Compound Yield: 5.18% with a 0.10% expense ratio [VMRXX held in a taxable brokerage account].

While short-term investment vehicles are great, it's important to have a strong foundation in personal finance education. How can you get all of the battle-tested, tried and true knowledge as quickly as possible? I wrote a book explaining exactly this; it's short; it's cheap, and it's written in plain English. You can find it here: https://amzn.to/32PLB3x. You may also want to consider subscribing to this blog by entering your email on the homepage next to the “Never Miss a Post” section and following the podcast “Nondelusional Investing” wherever you get your podcasts.

Is there anything you found useful or that I missed above? If so, please leave a comment in the comment box below.

See you on the next one!

Disclaimer: The article above is an opinion and is for informational/educational purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. The author has taken care in writing this post but makes no expressed or implied warranty of any kind and assumes no responsibility for errors or omissions. No liability is assumed for incidental or consequential damages in connection with or arising out of the use of this information.

Comments